Happy Saturday!

Welcome back to Polymath Playground (PP). What a wonderful and hectic week!

This week, I dug another rabbit hole into DAO projects. The more I learn about a DAO project, the more ignorant I feel. Chances are that I couldn’t write an analysis of a DAO every week, but it is definitely worth a try.

If you like this post, feel free to forward and share it.

As always, I would love to hear from you—any ideas, questions, comments, or say hi.

Featured: A DAO a Week Keeps FOMO at Bay

Bitcoin price has been soaring more than 20% in the past 30 days, making it the best-performing asset in Q1 2023, while the global crypto market cap follows suit.

Some argue that the optimistic vibe toward bitcoin and crypto is strengthened by the untrustworthy banking system after three banks’ collapse and takeover. Thus, some people are buying cryptos in preparation for a tsunami of financial crises like in 2008.

On the other hand, paying attention to the fear of missing out (FOMO) is always prudential practice, especially when the bull market trap comes around. No one can tell beforehand whether it is a bull trap or a reverse trend market, but we can learn the fundamentals of these decentralized autonomous organization (DAO) projects to increase our survival rate in the crypto market. Therefore, I decided to curate a DAO project and share it here every week (supposedly). “A Week A DAO Keeps your FOMO at Bay,” so to speak.

The first DAO project is AbitrumDAO. As of the time of writing, the total locked value (TLV) of Abitrum is $2.5 billion (Defillma, whereas the L2 Beat shows $6.5 billion of Arbitrum One TLV). Thus, it is the largest L2 scaling solution protocol. In addition, not only does it recently airdrop its native tokens to Abitrum users, but also it aims to solve the challenging scalability issue. The ongoing progressive decentralization tackling a real problem deserves our attention and applause.

My rule of thumb is to see the team behind a DAO before I start to learn its mechanism. AbitrumDAO is led by Offchain Labs, the three co-founders of which are Ed Felten (Chief Scientist), Steven Goldfeder (CEO), and Harry Kalodner (CTO). They are ex-White House Deputy CTO and ex-researchers at Princeton University. Although a glamorous resume can't guarantee success, performing a heuristic check is a valuable and natural step, keeping in mind that it can be biased and not entirely reliable.

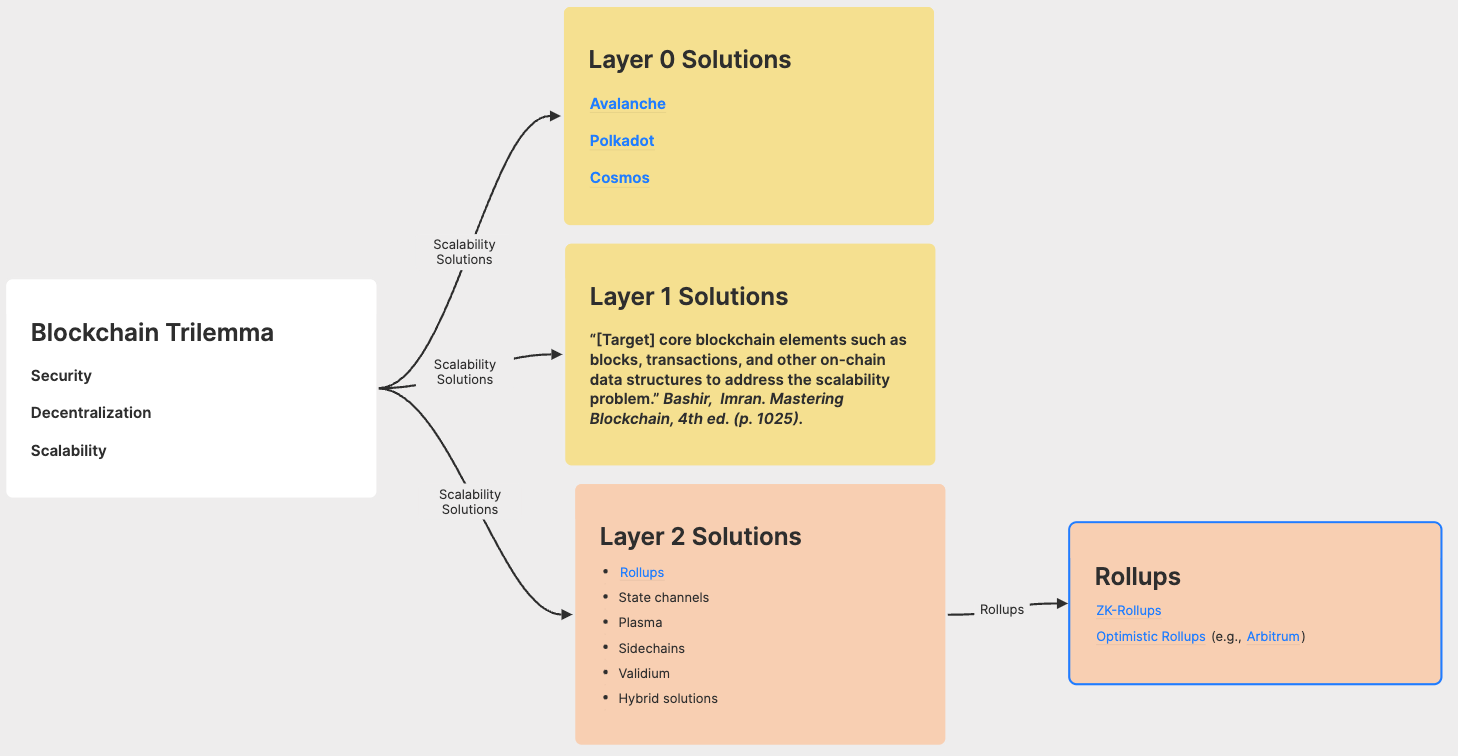

Before I explain how Arbitrum works and what values it brings to Ethereum, I want to introduce the idea of the Blockchain Trilemma: security, decentralization, and scalability, the three valuable features in blockchain applications that are hardly achieved at the same time. That is, we cannot have all of the three features: security ( the blockchain is resilient against malicious actors), decentralization (it doesn’t require permission or a chunk of resources to join in the network), and scalability (the amount of transaction blockchain can process per second). Most, but not all, people believe that we cannot get all three benefits without trading off any one of the three. For example, Ethereum’s low scalability and high transaction gas fee have been an unsolved challenge. Thus, many solutions exist from layer 0 to layer 2 (and beyond) to the scalability issue.

Arbitrum is one of the many scaling solutions for Ethereum. Without robust scalability, inclusive finance and use cases would remain the future of finance, rather than becoming a reality everyone enjoys.

As shown in the chart above, rollups are one type of layer-2 scaling solutions. To facilitate more transactions per second at the layer 1 level, rollups aim to process the transaction and then send batches of completed transactions back to layer 1 for final “settlement.”

There are two main subcategories of rollups: Zk-rollups and Optimistic rollups. Zk-rollups solution applies zero-knowledge proof when it processes the transaction at the layer 2 level. In contrast, Optimistic rollups use a fraud-proof mechanism (that is, it optimistically assumes a given transaction is valid unless challenged and proven otherwise). You can find more information about Optimistic rollups here.

Given that this week we highlight Arbitrum, I’ll quote Offchain Labs in supporting why Optimistic rollups are better than Zk-Rollups:

People want a chain that trustlessly offers safety, guaranteed progress, visibility, and quick finality — and they want it at low cost and compatible with existing tooling.

We dug into the details of how to provide those properties using an optimistic rollup compared to a ZK rollup.

Optimistic can provide the properties that users want, at lower cost, because of the very high off-chain costs of constructing ZK proofs.

Because ZK proofs are so expensive, full participation in a ZK protocol probably requires special-purpose hardware and/or massive parallelism, making the network effectively more centralized.

The claimed advantages of ZK either are available to optimistic systems too, or require sacrificing important security or usability features.

Optimistic rollup wins big on the cost of operation, because executing code is much cheaper than computing complex cryptographic proofs about it.

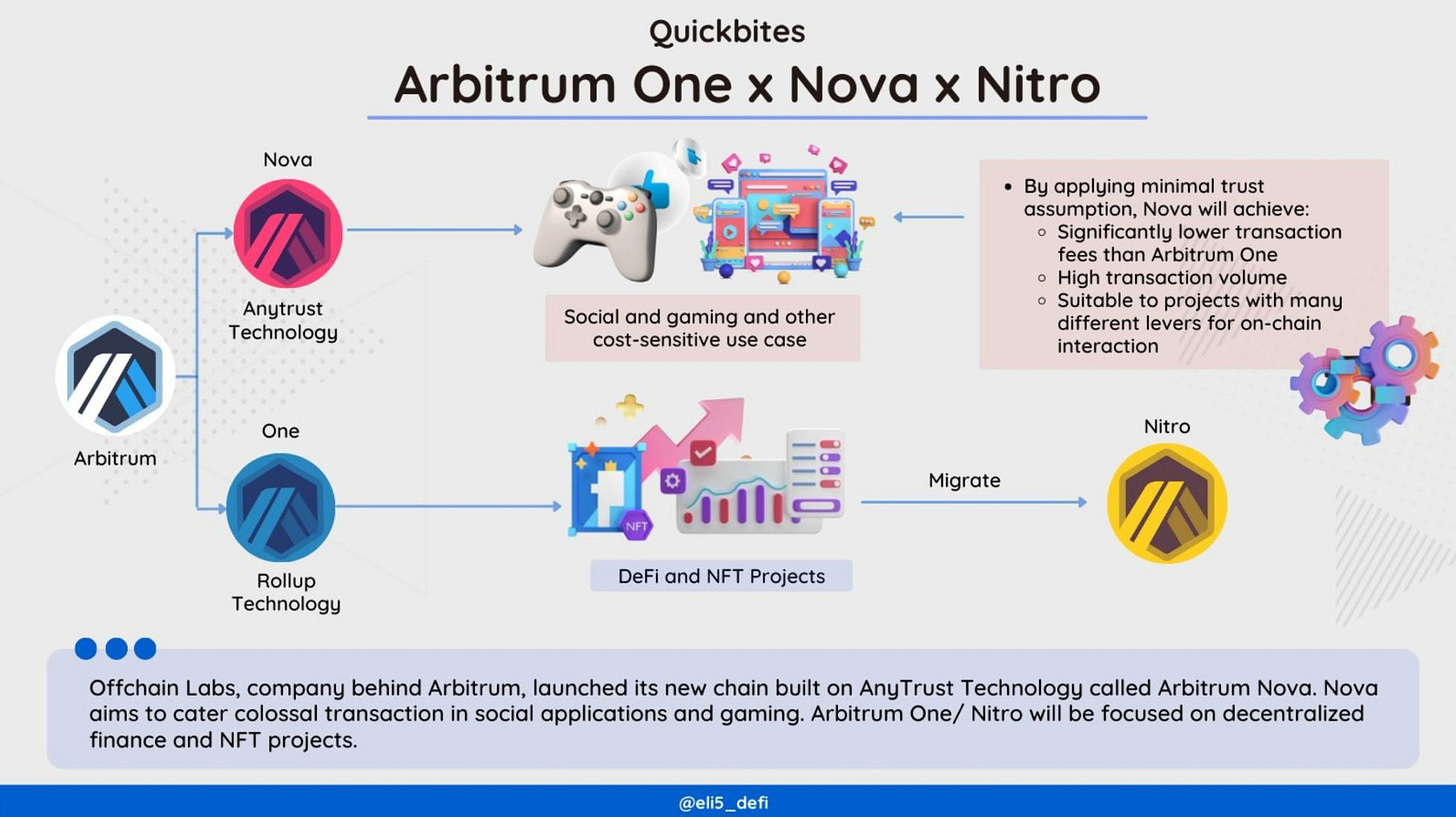

With all the background information, we can dive into Arbitrum. The recently airdropped Arbitrum token, ARB, is the naive governance token for ArbitrumDAO, which ultimately governs the protocols and networks like Abitrum Rollup (e.g., Abitrum One) and Abitrum AnyTrust (e.g., Abitrum Nova). According to its website, “Arbitrum Rollup and Arbitrum AnyTrust are protocols that make Ethereum transactions faster and cheaper. Developers use Arbitrum One and Arbitrum Nova, the chains that implement these protocols, respectively, to build user-friendly decentralized apps” because they are compatible with the Ethereum Virtual Machine.

A brief explanation of Arbitrum One and Abitrum Nova is shown below.

However, although Arbitrum DAO appears to have a promising future and the potential to become a permanent solution to Ethereum's scalability issues, it faces several challenges. Firstly, it must contend with competition from Optimism, which is collaborating with Coinbase and its millions of users. Moreover, withdrawing from Arbitrum One takes one to two weeks due to its adoption of a fraud-proof mechanism. Additionally, the system relies on verifier participation to catch fraudulent transactions, instead of using cryptographic proofs like Zk-proof.

In short, there are plenty of attempts to solve the scaling problem we face today in the crypto world. Thus, it is too early to tell whether Arbitrum DAO will become a sufficiently decentralized entity or whether Arbitrum rollups can prevail in the scaling solutions competition. Nonetheless, seeing a new DAO project thrive and grow is always a pleasure. While the future of Arbitrum DAO remains uncertain, its innovative approach and dedication to solving Ethereum's scaling issues make it a project worth watching. By staying informed and keeping an eye on emerging DAOs like Arbitrum, we can better navigate the ever-evolving crypto landscape and make informed decisions in this fast-paced market.

The Dual Duel: CFTC v. Binance

The CFTC filed a civil case against Binance and its founder, Changpeng Zhao, (as well as its Compliance head), accusing them of operating an exchange without proper registration and a “sham” compliance program. Some suggest the CFTC may have a strong case here.

In contrast, Binance claimed it “developed best-in-class technology to ensure compliance. Binance.com is the first global (non-US) exchange to implement a mandatory KYC program, and remains today to have one of the highest standards in KYC and AML. We block US users by nationality (KYC), IP (including commonly used VPN endpoints outside of the US), mobile carrier, device fingerprints, bank deposit and withdrawals, blockchain deposits and withdrawals, credit card bin numbers, and more.”

Given these conflicting interests and high stakes, a settlement may be the most reasonable path forward for both parties and the crypto industry worldwide. By reaching an agreement, Binance can continue focusing on improving its compliance measures and maintaining its reputation, while the CFTC can ensure that proper regulations are being upheld within the industry. However, a settlement is unlikely in the near future as regulation by enforcement is the dominant tune in the US, with regulators flexing their muscles towards the industry and Congress.

The Writer’s Muse

WRITING IS NOT A CONTEST.

Every writer is starting from a different point and is bound for a different destination. Yet many writers are paralyzed by the thought that they are competing with everybody else who is trying to write and presumably doing it better….Forget the competition and go at your own pace. Your only contest is with yourself.On Writing Well, William Zinsser

Whenever I start writing an introductory piece like this week’s featured, I feel like there are already excellent introductory articles out there, in addition to what ChatGPT can produce in seconds. Such a thought makes me doubt what value my writing could have.

However, writing is not a contest here, although it could be. This is a polymath playground where we exchange ideas and thoughts, celebrate the unique perspectives each of us brings, and recognize that every voice has the power to enlighten and inspire. If you are also on the journey of becoming a writer, I hope the quote from William Zinsser takes some pressure off your shoulder.

Stay Sharp & Safe,

Jason Lai

Disclaimer: Not legal advice. You can see the full disclaimer & disclosure here.

Credit: Originating from my idea and draft, this post was reviewed and edited by ChatGPT.